If you are graduating or make the decision to stop attending A&M-Corpus Christi, there are several things you should do and know prior to carrying out your plans.

How your awards are distributed

If you anticipate graduating or discontinuing your attendance at A&M-Corpus Christi, you should pay close attention to the amount of aid you accept. All amounts awarded will be issued in two disbursements. So, for example, if you were awarded and accept $5,000 in aid for the Fall and Spring semesters, you will receive one $2,500 disbursement in the fall and the other $2,500 in the spring.

I’m an undergraduate student graduating at the end of Fall, what does this mean for my federal student loans?

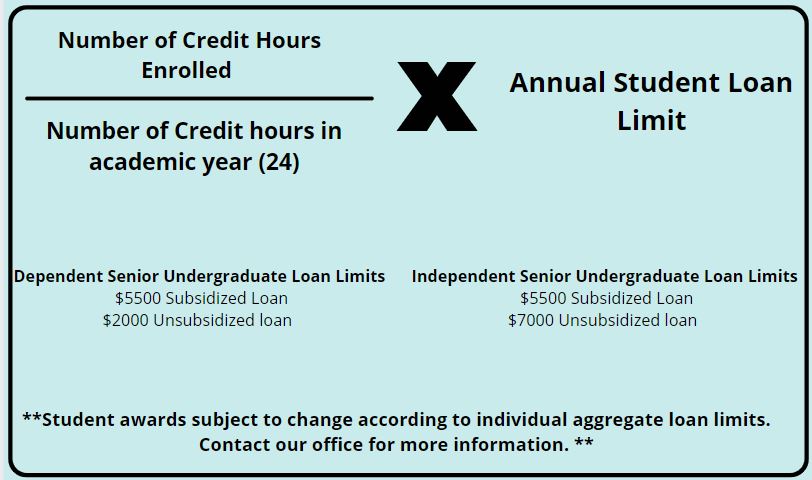

Financial aid is awarded based on full time enrollment (12 hours) for fall and spring. If you are enrolled less than full time and are graduating in the fall, federal regulations require that your student loans be prorated to reflect your less than full time enrollment.Loan proration impacts undergraduate students applying for graduation who are receiving Federal Direct Subsidized and Unsubsidized Loans. Federal regulations require schools to prorate the Federal Direct Loan amounts for graduating undergraduate students when their final period of enrollment is less than a full academic year. The loan limit proration determines the maximum loan amount that a student may borrow for the final term of study based on the degree they are earning. Graduating undergraduate students who are only attending one semester of the academic year will have their Federal Direct Loans prorated based on the number of credit hours they are enrolled. Note: Graduate and professional students are excluded from the loan proration requirement.

I'm an undergraduate student graduating at the end of Fall and am enrolled for the Spring as a graduate student, will my financial aid be okay? - video playlist

Active Student Level or Academic Information must be updated upon graduating. In this case, a student is updating their academic information from undergraduate to graduate student and acknowledging "I authorize the OSFA to update my FASFA to reflect that I am now enrolled in a graduate program" in the Type of Revision Requested section of the Change Request (Repack) Form form. Please complete the form and submit to our office.

What do I do if I'm transferring to another school? Can I transfer my financial aid, too?

No. Financial aid does not "transfer" from one institution to another. Each institution evaluates your eligibility according to their own terms, conditions, and available funds. Before transferring, you should notify our office of your plans so that we can cancel your aid and/or future loan disbursements for the upcoming semester. It is crucial that you perform this task, as you cannot receive financial aid from two institutions at the same time. Not canceling your aid here can ultimately affect being awarded any aid at another institution.

Exit Loan Counseling - video

If you are graduating, withdrawing from the University, dropping below half-time enrollment status, or are not enrolling or are no longer enrolled, you will be required to complete an exit loan counseling session for any student loans you have taken out during the course of your attendance

You may complete an Exit Loan Counseling session by attending one of our in-person exit programs on campus (please contact our office for dates and times) or online via Studentloans.gov. Failure to complete an Exit Loan Counseling session will result in a hold being placed on your student record. This hold will prevent you from registering for classes, obtaining transcripts, and other official academic matters.

NOTICE: Exit Counseling sessions for the Spring 2021 semester will be 100% online. If you are a Federal Student Loan borrower and are graduating Spring 2021 semester or transferring to another Institution, you are required to complete an Exit Counseling session. You can complete this task by logging into: https://studentaid.gov/app/counselingInstructions.action?counselingType=exit

Loan Repayment - video

Typically, once you graduate or stop going to school, you will be required to begin paying back your student loans within six months. Once your loans go into repayment, should your status change again, you can request that they be deferred (see section below). To find out how much you owe in student loans and your repayment options, click here.

Loan Consolidation - video

If you have taken out any student loans, you may be able to combine them into one loan, which could potentially give you lower monthly payments, lock in a fixed interest rate, and combine multiple loan balances to make just one monthly payment.

Loan Deferment - video

How/if you can defer paying back your loans will vary depending on what kind of loans you have. For Stafford and Perkins loans, the principal and interest payments may be deferred while you are:

If you do not qualify for a deferment for your Federal student loans, you can forbear your loans for up to three years instead. Forbearance is another way to temporarily postpone or reduce payments for a set period of time. You should contact your loan servicer for more information about forbearing your Stafford and/or Perkins loans.